Misclassification – Posted August 4, 2020

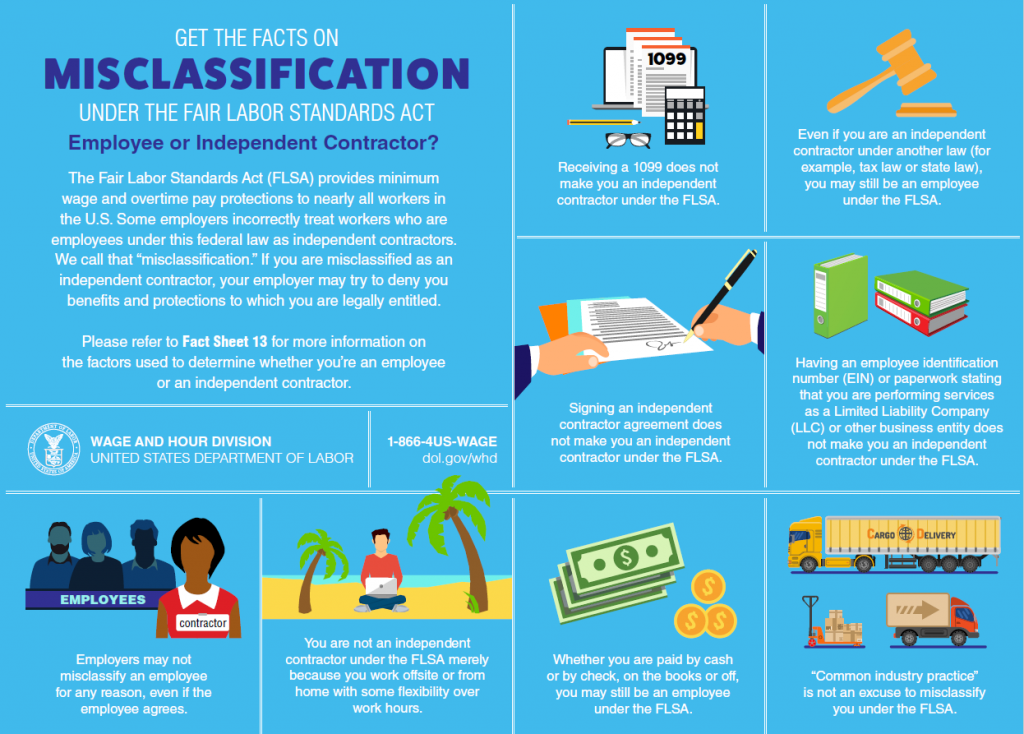

Workers in many fields are misclassified as independent contractors, when by law, they are really employees who would be entitled to minimum wage, overtime at the rate of time and one half, and would be entitled to have the employer bear the cost of work related expenses. By misclassifying workers, employers deny their workers the basic protections afforded to employees.

However, simply calling a worker an independent contractor does not make it so. The test of whether a worker is an independent contractor or employee comes down to how much control the business exerts over the work of the contractor, whether the contractor is performing the primary business of the company, whether the contractor has control over their own profit and loss, and whether the contractor is truly in business for themselves.

The misclassification of workers as contractors is common in industries such as truck drivers, delivery drivers, janitors, security guards, store delivery persons, and home health care providers such as nurses, home health aides, and various therapists. You can read more about misclassification here: https://www.dol.gov/agencies/whd/fact-sheets/13-flsa-employment-relationship